Reliance Bank launches new Key Worker Mortgage products and improves Shared Ownership product range

On Thursday 17th June 2021, Reliance Bank announces the launch of a range of new mortgage products to the Intermediary and Direct mortgage market.

The Bank has taken this opportunity to make a number of enhancements and improvements following feedback from our intermediary partners.

Please see our rate sheets on the Mortgage Support pages on the Reliance Bank website.

The new product range has been designed to reflect the recent changes in the mortgage market. Reliance Bank are delighted to continue to show support for key workers, through our dedicated Key Worker Mortgage product range, where the Bank has made a number of headline interest rate reductions for those key workers who have smaller deposits.

The Bank have also taken the opportunity to provide further support to those customers who are looking to own their home through the Shared Ownership scheme by utilizing our Shared Ownership product Range by introducing a £250 cash back, which will be paid to the customer within 60 days of them completing on their mortgage with us.

The Bank continues to offer the FREE basic mortgage valuation incentive for Remortgages with properties valued up to £750,000. As well as a £500 cash back for these applications. (staircasing + Shared Ownership Remortgage cases are excluded from the remortgage incentive).

Gareth Byrne – Head of Mortgages for Reliance Bank said “This latest range of mortgage products that Reliance Bank are offering via our Intermediary & Direct Channels are designed to help mortgage customers.

Either by looking to help those key workers who have low deposits being able to get onto the housing ladder, as we continue to see the cost of housing increase. Or, for those customers who are looking to buy their home under the Shared Ownership scheme with a housing association where we are now able to offer a cash back to help towards costs. We have also maintained our current remortgage incentives too for customers who are looking to remortgage to ourselves from their current provider.

I am really proud that the Bank remains committed to helping key workers as well as those who are looking to get onto the housing ladder through the Shared Ownership scheme. We are looking to help more people onto the housing ladder as well as increase the number of people who are looking to Remortgage over to Reliance Bank, which is evident in the number of changes we have made to our mortgage product proposition.”

The main key changes:

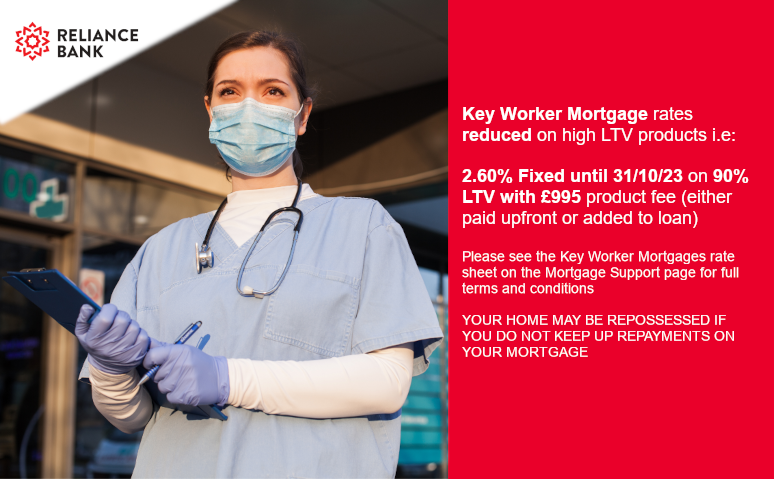

- Rate reductions for our Key Worker Mortgage product range across selected higher LTV products **

- For example: 2.60% Fixed until 31/10/23 on 90% LTV with £995 product fee (either paid upfront or added to loan)

- Introduced a £250 Cash back for all Shared Ownership applications where the customer is looking to borrow £50,000 or more *

* Cashback is paid within 60 days from date that the mortgage completes with Reliance Bank Ltd. Cashback does not apply to cases where borrowing amount is less than £50,000 qualifying loan amount.

** keyworker product range cannot be used in conjunction with any schemes, such as shared ownership or right to buy (RTB) and in order to qualify for a Reliance Bank Key Worker Mortgage Product at least one mortgage applicant must currently be employed in one of the qualifying occupations (see List of qualifying occupations for RBL Key Worker Mortgages which is on the Mortgage Support page).

Helping good people do great things with money

Reliance Bank has been at the forefront of socially responsible banking since 1890, when we were formed by William Booth the founder of The Salvation Army.

Why choose Reliance Bank for mortgages?

We offer a wide range of competitive mortgages

Fair and flexible lending options for first time buyers, re-mortgagers and home movers.

We’re helping more people onto the property ladder

Our mortgage range includes those designed to have a positive social impact, such as our new Key Worker Mortgage Product range and Shared Ownership Mortgages.

You’ll get direct access to our mortgage team

As a broker, you’ll have access to the mortgage team who can provide answers to your questions and make decisions quickly. Our level of service is execution only.

The power to change lives

The Salvation Army International is Reliance Bank’s shareholder. The Salvation Army help people whose lives have been affected by emergencies, disasters, poverty and social inequality.

To register with us call our mortgage team on 0207 398 5421 or 0207 398 5422 or 020 7398 5423 or email mortgages@reliancebankltd.com